By Maxime Delisle, FCIA, Member of the CIA Committee on Climate Change and Sustainability

A 2020 survey of CIA members shows that just under one third of respondents account for climate change risks in their actuarial work, a proportion similar to that indicated in a 2019 survey.

These results point to a continued need and growing interest from the profession for additional information and guidance on the subject. Driven by demand, the Climate Change and Sustainability Committee (CCSC) is committed to raising awareness among actuaries and helping bridge the knowledge gap with regards to climate change risks.

Purpose

Climate change was identified as the top current and emerging risk in the 13th Annual Survey of Emerging Risks (March 2020 – CIA/CAS/SOA). To monitor the evolving concerns of the actuarial practice in Canada, the CCSC issued a second edition of its climate change risks survey during the summer of 2020. Updated to gather more qualitative feedback, two versions of the survey were distributed to capture the perspectives of CIA members and a small, designated group of appointed and senior actuaries in leadership positions. The CCSC believes that this latter group could offer valuable insight from an organizational point of view.

The survey received 88 responses from members and 11 responses from the appointed actuaries’ group, for a total of 99 respondents. Survey results below are presented across all respondents, unless otherwise noted.

Key findings

- 26% of all respondents account for climate change risks in their actuarial work.

- 62% of all respondents would like to get guidance on climate change scenario building. There is also strong interest for information on the fundamentals of climate change risks and research related to climate change (50% of all respondents).

- Among the 74% of respondents who do not account for climate change risks in their actuarial work, the three main challenges identified were:

- lack of guidance and data;

- the difficulty in quantifying risks and impact on assumptions; and

- climate change risks are not a priority or are irrelevant to the work performed.

Climate change risks and actuarial work

The proportion of those accounting for climate change risks in actuarial work did not change significantly compared to the first survey. In the 2019 survey, 29% of respondents stated that they or their company account for the risk of climate change. Given the relatively small sample size of both surveys (about 100 responses), this year’s result of 26% is not significantly different.

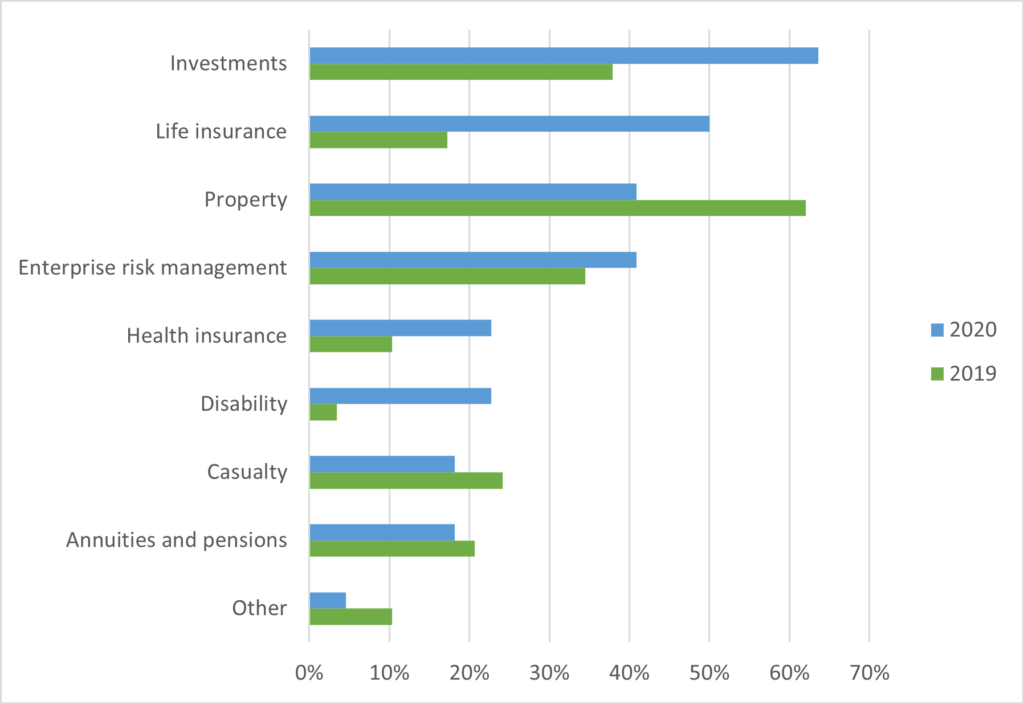

Focusing on the respondents who account for climate change risks in their work (26 respondents out of 99), it is interesting to note the distribution of the areas of practice and observe changes from last year. Respondents in life insurance (50%) and investments (63%) are more frequent than they were last year, followed by property and enterprise risk management (ERM).

Variations from one year to the next are expected given the small sample size. For example, of those respondents who account for climate change risks in their work, 38% had started doing so more than five years ago in the 2019 survey compared to 15% this year, despite the additional year that has elapsed. It seems that this year’s survey may have reached a different audience than last year’s survey, as such it is prudent to keep this in mind when analyzing the results. For example, the decrease in the property area of practice may not necessarily signal an underlying trend.

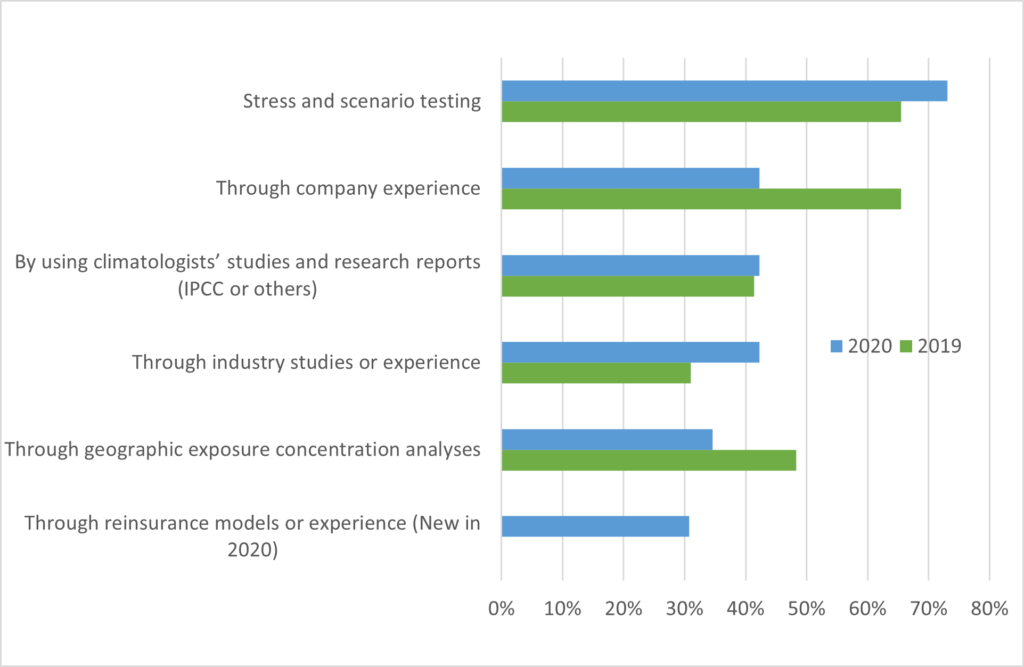

To account for climate change risks in actuarial work, 73% use stress and scenario testing. This is the most frequent tool reported among those who reflect climate change risks in their work. Around 40% rely on industry studies or experience, or refer to climatologists’ studies and research reports for additional information on climate change.

When asked about the first step taken to account for climate change risks in actuarial work, most answers fall in one of these categories:

- Do stress testing (30%)

- Gather research and get education on the risk related to climate change (22%)

- Understand the impact to trends and possible impacts (22%)

- Consider ESG factors for company’s investment or to advice clients on ESG (9%)

- Exposure analysis of past events and historical data (9%)

- Other (9%)

Improving climate change risks recognition in actuarial work

Understanding the main challenges and obstacles from incorporating climate change risks in actuarial work was another key objective of the survey. As such, a new question was added to the survey to better capture the unmet needs of the CIA community. Many respondents share the same challenge of directly linking climate change with the actuarial work they perform. Once again, open-ended feedback was aggregated and summarized into the following categories (some responses were allocated to more than one category):

- Difficulty of quantifying the risk/impact or setting assumptions (32%)

- Not a priority or irrelevant to the work performed (27%)

- Lack of guidance (21%)

- Lack of data (13%)

- Unsure if it is a risk for actuarial profession (11%)

- Other (9%)

Considering the above feedback, most respondents who do not account for climate change risks have no current plans to do so in the foreseeable future – a proportion (67%) similar to that obtained in last year’s survey (70%).

Another key objective of the survey was to gauge the relevance of better understanding climate change risk within the actuarial profession. Actuarial organizations worldwide are also looking into this matter to better equip themselves to face the growing uncertainty of climate change risk.

Most comments addressing this specific topic support the relevance of better understanding climate change risk among actuaries. There was also a portion of the membership that expressed curiosity in the CIA’s involvement; insight that provides valuable feedback to the CCSC. Lastly, a small minority of respondents questioned the relevance of climate change risk in actuarial work, and in some cases argued against the very existence of climate change itself.

As of today, there is no mandatory requirement to incorporate climate change risks in actuarial work. However, regulators in Canada, and abroad, are looking at this issue closely. Some respondents stated that they do not reflect climate change risks in their work because of the absence of mandatory requirements. Some also suggested that the CIA should collaborate with industry groups and regulators on climate change risks initiatives. As climate change risks increase, regulatory requirements may likely be implemented gradually – a proactive approach which may prove beneficial to the profession.

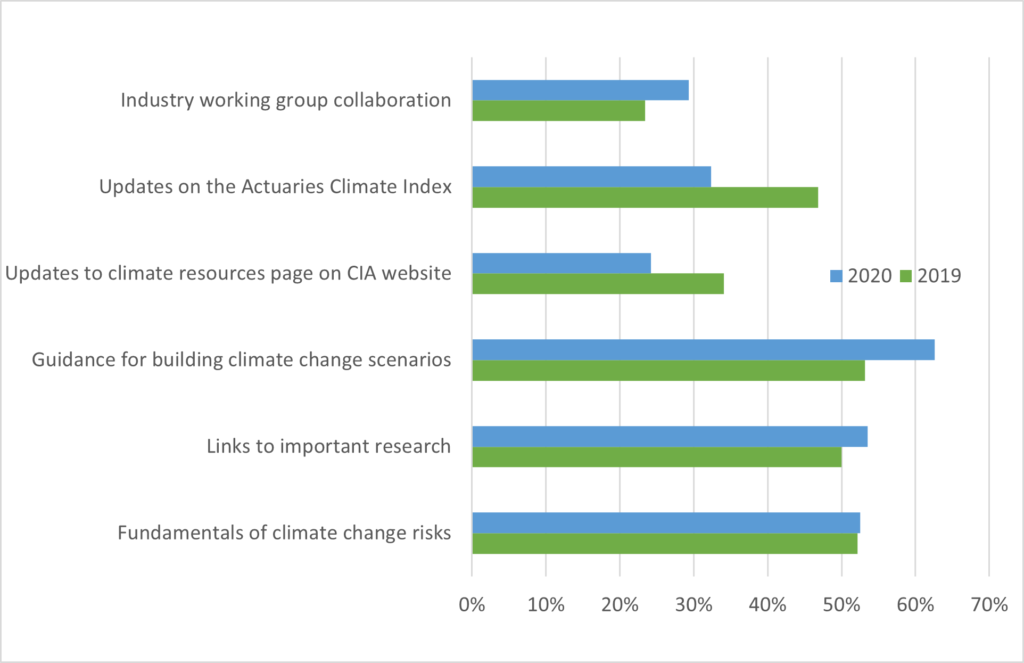

Consistent with last year’s results, the survey suggests that there is still a strong willingness from the membership to seek guidance on climate change scenarios, research papers, and fundamentals of climate change as illustrated in Chart 3.

In terms of existing resources, the majority of respondents (88%) were aware of the Actuaries Climate Index with the other popular resources being the Principles for Responsible Investment and the CIA Climate Change and Sustainability Resources page (40% of respondents).

Next steps

The CCSC thanks all respondents for their valuable feedback. Understanding where CIA members stand on climate change risks is key to helping set the priorities of the CCSC. The feedback received through this survey suggests that more data and guidance are needed for the actuarial community to remain a leading-edge profession.

The CCSC will continue raising awareness on climate change risks and will also continue seeking feedback from all CIA members and senior leaders. Meanwhile, those interested can learn more about climate change and work done on the topic by other actuarial associations by visiting the CIA Climate Change and Sustainability Resources page.