Actuarial interest in COVID-19 is being approached from several angles, the most obvious being the impact on longevity and healthcare costs and how the pandemic might affect insurance and benefit plans. The economic disruption that accompanied the pandemic has also led actuaries to consider what will happen with long-term investment returns, and the impact on pricing and funding.

Yet even with all this to consider, there are still other areas that could benefit from the application of actuarial expertise, such as the use of risk management techniques in a pandemic response.

A recently released CIA research paper looks at this very topic.

The three pillars of pandemic preparedness

Pandemic Risk Management: Resources Contingency Planning and Allocation, authored by Xiaowei Chen, Wing Fung Chong, Runhuan Feng, and Linfeng Zhang from the University of Illinois, presents a risk management framework to help governments and public health agencies prepare for future pandemics.

The need for this preparation became evident in the early days of COVID-19, particularly in the United States. Despite having a vast network of medical professionals, well-equipped facilities, and hospitals, there remained a critical shortage of diagnostic and preventative medical supplies. This shortfall hindered the ability of the medical system to react to the rapidly growing crisis. Unreplenished stockpiles, manufacturers forcibly moved to “just in time” production, and a lack of coordination between federal and state governments in the deployment of resources all contributed to making an already bad situation worse.

The authors look at the experience in New York, Florida, and California – each of which experienced peaks at different times during the pandemic – and postulate how a risk management framework could have led to more efficient stockpiling and allocation strategies.

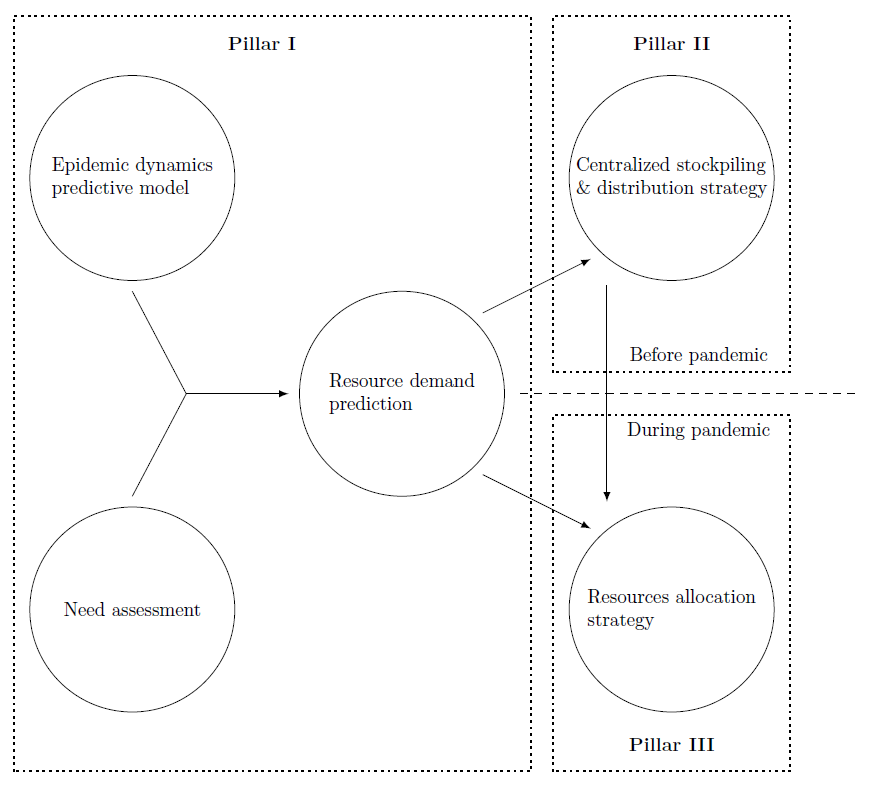

Their central element is a three-pillar strategy:

- Pillar one: addresses pre-pandemic preparation, whereby the supply of and demand for medical resources is forecasted ahead of time.

- Pillar two: covers the development of a stockpiling and distribution strategy.

- Pillar three: presents the requirements for a central authority that would oversee the allocation of resources as needed.

A particularly insightful aspect of this research is the parallel seen between pandemic risk management and capital risk management. Identifying risks in an organization such as an insurance company is analogous to the preparation step in pillar one. The development of risk-based capital is similar to the stockpiling strategy in pillar two, and capital allocation matches closely to pillar three.

Building a robust framework

Some less rigorous risk management exercises can end up being reduced to the development of a list of risks and exposures without proposing models that can be used to develop a framework. However, the authors do the opposite, presenting a model that helps determine, among other things, the optimal size of a stockpile.

To forecast the need for medical supplies and equipment, the authors use a forecast model that divides the population into seven categories – susceptible, exposed, mildly infected, infected with hospitalization, infected in intensive care, recovered, and deceased – leading to the acronym SEIRD. They also consider two types of medical resources – durable and single-use – presenting forecast models for each. For example, a ventilator would be considered a durable resource, where medical masks would be categorized as single-use resources.

The appeal of this research to actuaries is clear, especially to those wanting to advance the application of actuarial techniques to the world of enterprise risk management or maybe even beyond.