In the 2020 Retirement Risk Survey, conducted in partnership with Ipsos, the CIA asked Canadians a series of provocative questions about their retirement and long-term planning. The survey focused on how well Canadians understood longevity and life in retirement, and how accurate their expectations are around being disabled in retirement, needing long-term care, and more.

The key findings report penned by FCIAs Anna Doudina, Andrea Kojlak, CIA Staff Actuary Chris Fievoli, Krista Sacrey, and Umair Ali, summarizes the results. This five-part series of articles begins with a summary and then explores the report’s key areas of focus in more detail: impact of COVID-19, retirement age and life expectancy, financial plan for retirement, and living arrangements and long-term care.

In this article, we look at how COVID-19 has impacted Canadians and their perceptions of retirement.

A pandemic shift

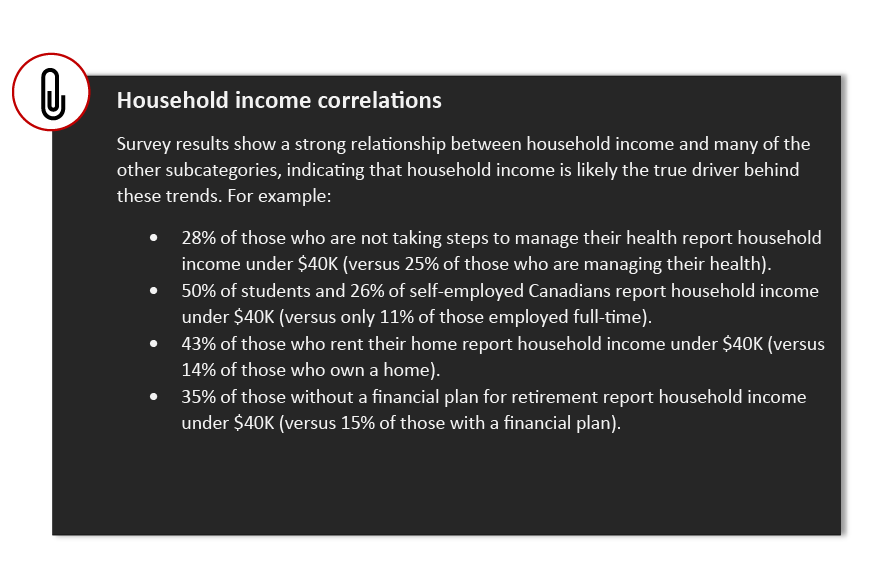

When surveyed in summer 2020, a significant number of Canadians were already feeling the financial sting of the COVID-19 pandemic. 36% of Canadians reported earning less household income due to the pandemic, with higher percentages seen amongst those born outside Canada (48%), non-retirees (43%), and members of the GenZ generation (58%).

With Canadians earning less, increases in debt followed suit. The report reveals 25% of respondents took on additional debt due to the pandemic, with higher percentages seen amongst students and self-employed Canadians (both at 33%). Also exposed were those who rent their home (34%) and those without a financial retirement plan (32%).

In addition to immediate impacts on household income and debt, COVID-19 has also changed individuals’ retirement timelines, with nearly one in four non-retirees (or whose spouse is not retired) (23%) reporting that it has impacted their (or their spouses) plans to retire. The following table below outlines the specific impact and underlying reason.

| Impact and reason | Proportion of respondents that chose the option |

| I and/or my spouse will work longer than planned because we need the income. | 69 % |

| I and/or my spouse will work longer than planned because at least one of us can work from home and avoid the health and safety risks of going into work. | 18 % |

| I and/or my spouse will retire sooner because at least one of us is concerned about our health and safety going back to work. | 8 % |

| I and/or my spouse will retire sooner because at least one of us has already been laid off or lost our job. | 7 % |

| Other | 5% |

The impacts of COVID-19, however, do not stop there. With long-term care homes hit the hardest throughout the pandemic, views on assisted living facilities quickly turned sour.

When polled, 63% of Canadians said they have a more negative view of assisted living facilities because of the COVID-19 pandemic, with higher percentages seen amongst females (67%), retirees (70%), and those with chronic health issues (71%). Countering this trend, we see a significantly lower percentage (49%) amongst those living in Saskatchewan and Manitoba.

With the pandemic in its fourth wave, the Canadian retirement landscape remains a vulnerable sector. The findings of the report, though concerning, illustrate an undeniable fact that, more than ever, Canadians need support and information about how to manage their retirement and long-term care needs in old age.

How has COVID-19 impacted your retirement plans? Let us know in the comments below.

Read the next article in the series, Outliving one’s income in retirement.

Read the full report.