In the 2020 Retirement Risk Survey, conducted in partnership with Ipsos, the CIA asked Canadians a series of provocative questions about their retirement and long-term planning. The survey focused on how well Canadians understood longevity and life in retirement, and how accurate their expectations are around being disabled in retirement, needing long-term care, and more.

The key findings report penned by FCIAs Anna Doudina, Andrea Kojlak, CIA Staff Actuary Chris Fievoli, Krista Sacrey, and Umair Ali, summarizes the results. This five-part series of articles begins with a summary and then explores the report’s key areas of focus in more detail: impact of COVID-19, retirement age and life expectancy, financial plan for retirement, and living arrangements and long-term care.

In this article, we look at how much Canadians are saving for retirement, their options in the event of financial shortfall, and whether insurance factors into their planning at all.

Unplanned futures

Despite being associated with a more comfortable, confident retirement, more than half of Canadians do not have a financial plan for their retirement, which results in most retired Canadians having less income in retirement than they did when working. Compared to 80% of individuals who do have a plan and expect to live comfortably in retirement, this is a discrepancy that may indicate an earlier need for intervention.

The reasons for not having a financial retirement plan vary widely among respondents. From citing unaffordability and age to a lack of dependents – understanding why individuals aren’t saving is a challenge filled with complexity and contradiction.

The 2020 Retirement Risk Survey breaks down respondent’s data further, revealing that nearly one in five Canadian retirees (19%) report having less than $25,000 in savings and investments. It’s important to note that the overall savings picture has improved since the last two retirement risk surveys, with a larger proportion of retirees falling into the higher savings and investment bands.

| Retirees | 2020 | 2012 | 2010 | 2020 vs. 2012 | 2020 vs. 2010 |

|---|---|---|---|---|---|

| Less than $25,000 | 19% | 19% | 23% | 0% | (4%) |

| $25,000 to less than $50,000 | 7% | 12% | 15% | (5%) | (8%) |

| $50,000 to less than $100,000 | 8% | 11% | 11% | (3%) | (3%) |

| $100,000 to less than $250,000 | 15% | 15% | 17% | 0% | (2%) |

| $250,000 to less than $500,000 | 16% | 12% | 8% | 4% | 8% |

| $500,000 to less than $1 million | 11% | 7% | 6% | 4% | 5% |

| $1 million or more | 7% | 4% | 3% | 3% | 4% |

| Don’t know | 16% | 21% | 17% | (5%) | (1%) |

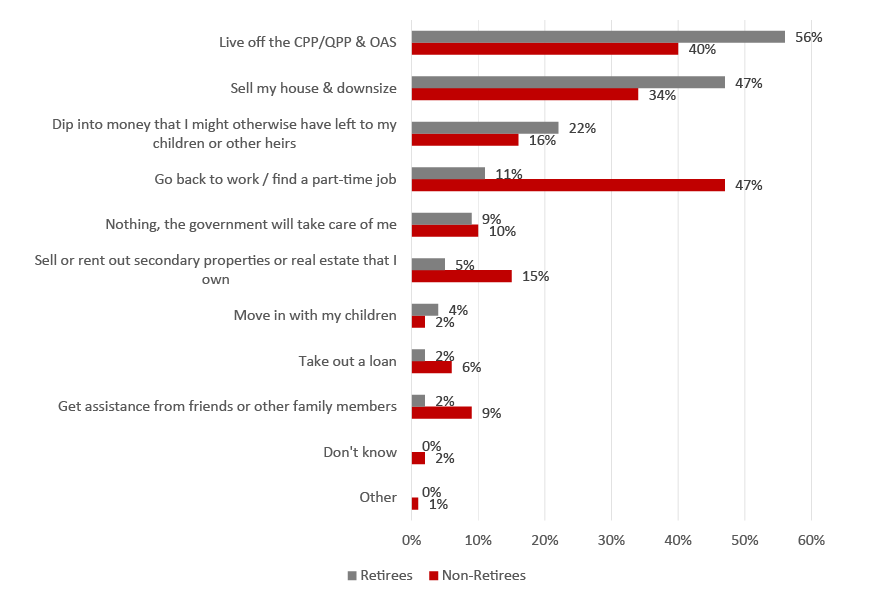

Findings also show that almost half (44%) of Canadians say they would live off the Canadian Pension Plan/Quebec Pension Plan and Old Age Security payments if their savings were to run out, a figure which jumps to nearly six in ten (56%) among retirees. Interestingly, non-retirees are over four times more likely (at 47%) compared to retirees (11%) to say they will be willing to go back to work and find a part-time job if they are short on cash in retirement.

To provide a better understanding of how much one would need to retire comfortably, the report authors calculated a retirement savings projection. Assuming 2% inflation and 3.5% post-retirement rate of return for 20 years, it is estimated that someone retiring at age 65 would need approximately $900,000 in savings to earn $50,000 in annual retirement income.

A future without a safety net

But it isn’t financial instability alone that is leaving many Canadians vulnerable. In addition to a lack of interest in and/or knowledge of retirement savings plans, many individuals do not have life or health-related insurance.

Moreover, more than one in three Canadians (37%) do not own any of the following types of insurance: life, disability, critical illness, or long-term care. This figure is even higher at lower incomes (58% amongst those earning under $40K) and younger generations (58% for GenZ). Among these types of insurance, life insurance has the highest uptake at 54%, while only 12% of Canadians report having long-term care insurance.

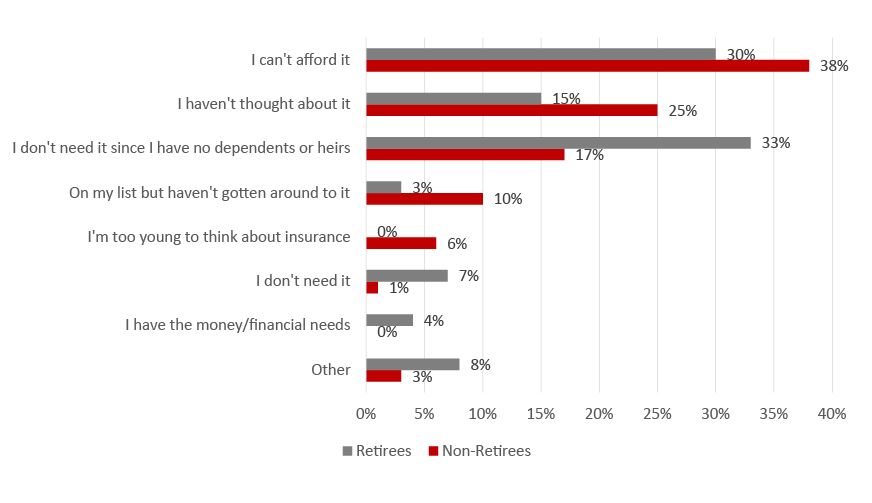

The figure below highlights the respondents’ reasons for not buying insurance:

“When reviewing the data, many of the responses stood out to us because they were unexpected or concerning or both,” says co-author Krista Sacrey, FCIA. “We’ve constructed this key findings report to call attention to the responses so that the actuarial community can bring their problem-solving skills to bear on some of these underlying issues.”

Do you think you are financially prepared for retirement? Let us know in the comments below.

Read the next article in the series, Anticipating the need for long-term care and its costs.

Read the full report.

The following comments were shared by readers:

Ellen Whelan: Yes i believe I am prepared. I have a financial planner and am working towards building a solid and stable pool of assets. I have a couple properties, life and disability insurance and am just building my retirement income to sufficient levels to also cover off any private health care expenses I may have also. When I feel I have enough squirreled away, then I will retire and find my new life!

Yes i believe I am prepared. I have a financial planner and am working towards building a solid and stable pool of assets. I have a couple properties, life and disability insurance and am just building my retirement income to sufficient levels to also cover off any private health care expenses I may have also. When I feel I have enough squirreled away, then I will retire and find my new life!