By Kailan Shang, ACIA

Pandemic and epidemic events cause losses to the insurance industry not only through insurance claims but also through disturbances to social and economic activities. Although it is difficult to predict what will happen in the future, it is important to understand the possible scenarios and get prepared.

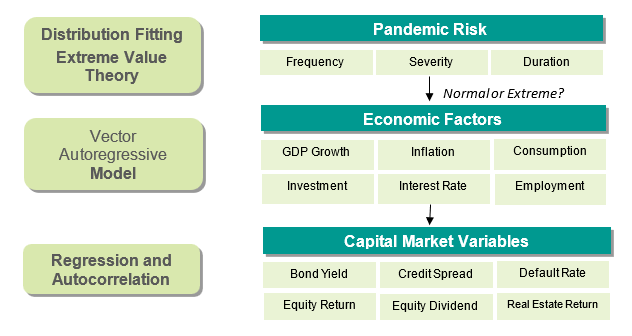

Stress testing is typically used by insurance companies to assess exposure to pandemic risk. The stress scenarios are usually based on single historical events such as the 1918 Spanish flu, or on a broader analysis of pandemic dynamics using epidemiological models such as the susceptible-infectious-removed (SIR) model and its variants. However, the stress-testing approach may be insufficient insofar as it does not reflect the distribution of pandemic events and their financial impacts. An integrated scenario generator that incorporates insurance risk factors, economic risk factors and capital market factors can provide a more holistic view of pandemic events, with a possible structure described in Figure 1.

Figure 1. Pandemics-driven scenario generation framework

The pandemics-driven scenario generator (PSG) uses a basket of fitted distributions to generate pandemic events, including their frequency, severity and duration. Based on their severity, the generated pandemic events will then drive the generation of macroeconomic factors, which are in turn reflected in the generation of capital market variables such as bond yield, credit spread, default rate and equity return.

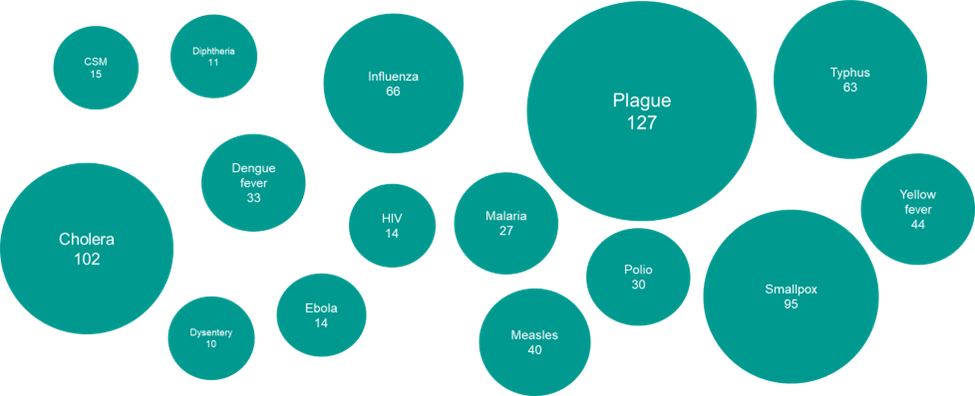

To supplement the existing stress-testing approach, an analysis of pandemic and epidemic events in recorded human history was undertaken. More than 800 historical events covering 3,000 years were used to study the frequency, severity and duration of pandemics/epidemics. Fifteen diseases – shown in Figure 2 – represented 84.5% of recorded historical events. Certain variables, such as frequency and duration, have heavy right tails and need to be modelled using extreme value theory.

Figure 2. Most frequent diseases

The impact of pandemic and epidemic events on an economic system can be material, as witnessed in the recent COVID-19 outbreak. Reduced economic activity, heightened market volatility, more relaxed fiscal and monetary policies, and nonlinear relationships were commonly observed during pandemics.

Depending on the modelling frequency, traditional methods such as correlation matrices and copulas showed limitations in capturing both contemporary and temporal relationships. Structured models such as vector autoregressive (VAR) models are more suited to reflect the chain of actions.

A comprehensive PSG can simulate nonlinearly correlated pandemic events and economic variables. It provides simulated variables to help insurers measure the impacts of pandemics on claim experience, financial conditions, new business and other profitability and risk factors in a holistic way. The PSG can be used to generate stochastic scenarios to facilitate the quantification and management of pandemic-related risks. Extreme pandemic events are embedded into individual scenarios, which also govern the behaviour of the economic system during those simulated events.

It is also important to have the flexibility to incorporate different views of pandemic risk and the potential impacts of a pandemic on the economic system and insurance sector, as structural changes may make historical experience irrelevant. This can be achieved by either changing the data inputs for PSG calibration or setting the parameters directly based on alternative analysis.

This article is adapted from the research paper entitled Pandemic-Driven Scenario Generation, sponsored by the CIA with the open-source R codes available for educational purposes.