By FCIAs Robert Berendsen and Catherine Sun

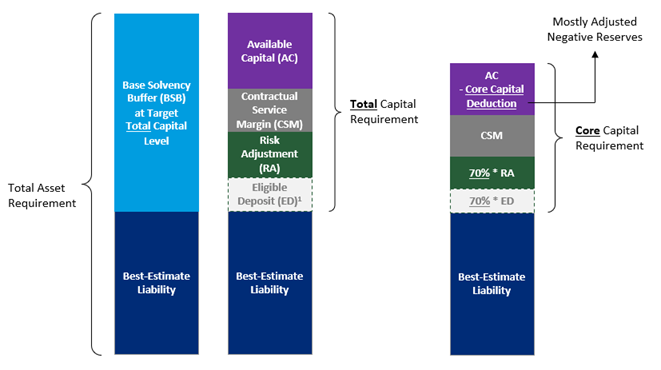

Effective January 1, 2023, insurers that report on an International Financial Reporting Standards (IFRS) basis are required to apply IFRS 17 Insurance Contracts (IFRS 17). In adapting to IFRS 17, the Office of the Superintendent of Financial Institutions (OSFI) has revised the Life Insurance Capital Adequacy Test (LICAT) 2019 guideline and published LICAT 2023, with an intention to minimize industry-wide capital impacts on the implementation of IFRS 17. The exhibit below illustrates the total and core capital composition under IFRS 17/LICAT 2023.

OSFI intended for LICAT 2023 to not materially affect the industry-wide capital requirement for all insurers, and further believes that such aggregate requirements will not be more volatile over time than the previous requirements. While that may be fair at the industry level, we certainly expect many insurers to experience increased volatility of their individual capital ratios, though primarily due to the IFRS 17 measurement framework rather than the LICAT 2023 construct.

This article focuses on total capital and core capital volatility under IFRS 17 and LICAT 2023, for insurance products evaluated under the General Measurement Model. Products evaluated under the Variable Fee Approach typically experience lower capital volatility thanks to the “pass-through” feature. Products measured under the Premium Allocation Approach are generally short term and do not experience significant capital volatility either.

Exhibit: Capital Composition under IFRS 17/LICAT 20231

Source: Oliver Wyman

New challenges, under IFRS 17, in asset liability management

For Canadian insurers, the most notable change when moving from IFRS 4 to IFRS 17 is the delinking of assets and liabilities, resulting not only in income volatility, but also additional capital volatility.

Under IFRS 17, liability discount rates are no longer derived directly from the projected portfolio yields of the supporting assets and future assumed reinvestments, as they were under the Canadian Asset Liability Method (CALM) used for IFRS 4. Instead, they are set based on market consistent risk-free rates and the liquidity characteristics of the liability cash flows. Importantly, market risk premia – particularly those from non-fixed income asset classes – are not included in the derivation of the liability discount rates.

These changes in the construct of the liability discount rates have an impact not only on the resulting amount of the liability, but importantly also on the sensitivity of that amount to changes in fixed income market conditions, i.e., it affects the assessment of the asset-liability mismatch position, at least when viewed through an IFRS lens.

As an aside, the sensitivity of the IFRS 17 liability to changes in market conditions is equivalent to the sensitivity of the fulfilment cash flows (FCFs). The contractual service margin (CSM) is rolled forward using locked-in rates and is not sensitive to changes in financial market conditions. This is an important realization where the CSM is a significant component of the liability. For example, insurers may have had a positive IFRS 4 liability and, under IFRS 17, still have a positive liability but a negative FCF.

Insurers that have a positive FCF may experience heightened capital volatility from changes in financial market conditions, as the impact of those changes on liabilities will in most cases be different under IFRS 17 than it was under IFRS 4 and may no longer be as well aligned with the impact of those changes on assets. This will be particularly true if the insurer’s assets have significantly different liquidity characteristics than its liabilities. Insurers that experience this can explore the following strategies:

- Holding assets that better mimic the liquidity characteristics of the liability cash flows. For example, replace non-fixed income assets with fixed income assets without materially compromising on yields; this may be easier to achieve in today’s higher interest rate environment than it was a couple years ago. This will help reduce the difference between asset returns and the insurance finance expense under IFRS 17, and in turn lead to more stable income and capital from financial activities.

- Adopting an entity level view of assets and asset liability management (ALM). The CALM framework under IFRS 4 incentivized insurers to create asset segments to support distinct liability segments, or else set up larger provisions for interest rate risk within each liability segment. Most insurers therefore had several asset segments, even within legal entities or business groups, and each segment was managed to provide the optimal outcome for the targeted liability segment or for surplus assets. Some insurers used an entity level overlay within their surplus segment to manage or adjust entity level exposures regardless of what was done within each asset segment.

Depending on how IFRS 17 liability discount rates are set, IFRS 17 either reduces or eliminates this incentive to segment assets. Insurers now have more flexibility to adopt a simpler entity level view of assets and ALM. Some insurers are combining segments and even no longer holding a separate segment to hold so-called surplus assets. If the change to IFRS 17 warrants a rebalancing of asset holdings (which in many cases it does), this can more easily be done at the entity level, including using an aggregate derivatives overlay (e.g., an interest rate swap) to reduce the net exposure to interest rate risk.

For insurers that have overall negative FCF, the interest rate sensitivity of assets and liabilities are additive. This may be markedly different from what it was under IFRS 4. In this case, the most effective solution to managing capital volatility from changes in financial market conditions is to reduce the overall asset duration. A few strategies worth considering include:

- Using reducing asset duration, with transaction costs and asset returns in mind. In today’s market, consider taking advantage of the inverted yield curve and investing in short-term fixed income assets.

- Using reinsurance with a financing element that acts to shorten liability duration. The reinsurance structure involves shifting the company’s net liability cash-flows and thereby shortening the liability duration.

- Using a derivative overlay, for example, entering into a pay-fix-receive-floating interest rate swap, to reduce the overall asset duration.

Navigating core capital volatility changes

In addition to the factors that influence total capital, core capital is also affected by changes in the risk adjustment and negative reserve. As illustrated in the exhibit, only 70% of risk adjustment, and a portion of negative reserves are considered core capital. For companies that focus more on core capital, volatility in these two elements should also be monitored.

Risk adjustment

IFRS 17 defines the risk adjustment as the amount of compensation the entity requires for bearing the insurance risk. In pricing insurance products, this is often tied to the cost of holding capital for insurance risk. In principle, volatility in the risk adjustment is expected to decrease under IFRS 17, considering that insurance risk is relatively stable over time.

However, differences in risk adjustment methodology can introduce unintended capital volatility. For example, insurers that continue to adopt the IFRS 4 margin approach may experience volatility due to fluctuation in the IFRS 17 discount rates. To manage this, insurers can do the following:

- Review the risk adjustment level based on the insurer’s required compensation for bearing insurance risk. Consider moving any excess risk adjustment into the CSM, since the CSM is discounted at the locked-in discount rate and not interest sensitive. In addition, the CSM is treated more favourably than risk adjustment under LICAT 2023, so this strategy will also provide a boost to the insurer’s core capital.

- Revisit the risk adjustment methodology and consider a cost of insurance risk capital type approach that is less sensitive to economic changes.

Negative reserves

Under LICAT 2023, the deduction from core capital for negative reserves changed from the padded basis to the best-estimate basis, which significantly increased the deduction amount. On the flip side, OSFI also increased the “amounts recoverable on surrender” that insurers are allowed to apply to reduce this deduction.

In our experience, the industry has not observed significant core capital volatility due to negative reserves. However, the calculation has become more complex under LICAT 2023, and insurers are encouraged to monitor the negative reserves behaviour and better understand the volatility going forward.

Capital management requires customized solutions

Under IFRS 17 and LICAT 2023, the delinking of assets and liabilities has contributed to increased capital volatility. Yet, IFRS 17 provides an opportunity to streamline certain activities on the asset side of the business; adjustments to the asset segmentation, actual asset holdings and the granularity of ALM activities can significantly mitigate the impact caused by the change to IFRS 17 and delinking. There is no one-size-fits-all solution to capital management in an IFRS 17 world, any more than there was in the IFRS 4 world. Insurers should understand their situation and customize a solution after weighing the pros and cons of available options.

This article reflects the opinion of the authors and does not represent an official statement of the CIA.

- Eligible deposits are collateral provided by an unregistered reinsurer, for the cedant to take credit for business ceded to the reinsurer. This is not discussed in this article. ↩︎